ROI case study: Boomi at a regional bank

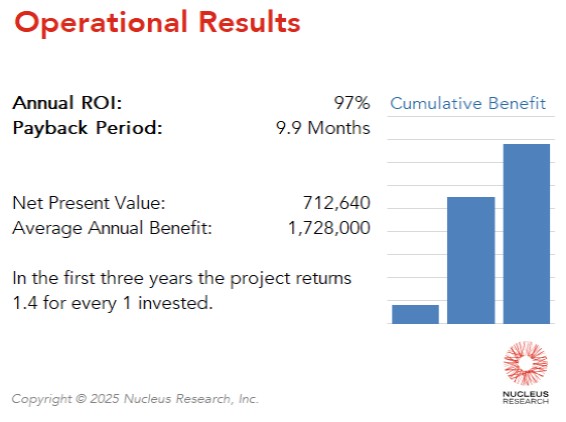

A regional bank achieved a 97 percent return on investment (ROI) with a payback period of 9.9 months after deploying Boomi to support its back-office financial processes including commercial loan booking, CIP and bankcard review, customer verification, account opening, and account validation. By centralizing these workflows, the bank reduced administrative overhead by 66 percent, shortened processing times, and eliminated system silos that had previously caused errors and data inaccuracies. Now spared from extensive manual integration, developers have achieved 60 to 82 percent time savings and operations staff have shifted their focus to more strategic initiatives. As a result, the bank is now poised to scale its operations and deliver enhanced services to its expanding customer base, maintaining a strong competitive edge in an evolving financial landscape.