ROI case study: Palantir at Swiss Re

Have a specific question? Query our research catalogue with the Nucleus AI Tool.

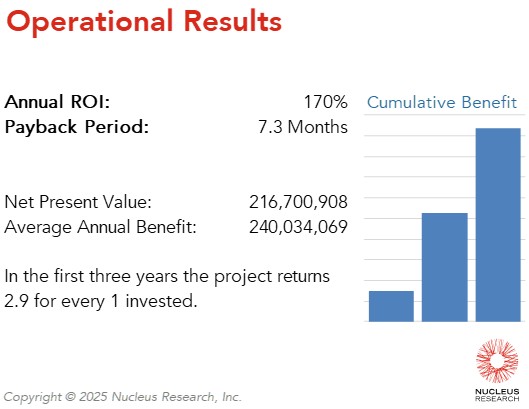

Swiss Re, a global leader in reinsurance, achieved an ROI of 170 percent with a payback period of 7.3 months after consolidating its data estate through the implementation of Palantir. This transformation led to a 70-80 percent reduction in reporting time, 30 percent time savings for underwriters, and a 50 percent productivity gain for data engineers and architects. By unifying its data ecosystem with Palantir, Swiss Re eliminated operational silos, allowing underwriters, actuaries, and data teams to collaborate more effectively while improving the speed and accuracy of risk assessment. Additionally, Palantir’s machine learning capabilities improved risk modeling processes by automating data analysis and identifying patterns in historical claims, while its automated data pipelines and reporting reduced manual errors and inconsistencies, leading to greater accuracy in underwriting decisions. With a more flexible and data-driven approach enabled by Palantir, Swiss Re is better positioned to adapt to market shifts and drive long-term efficiency and growth.

Learn more about Nucleus Research’s ROI case study approach here.

Gain the knowledge you need to effectively develop and deliver a financial business case at ROIUniversity.com.