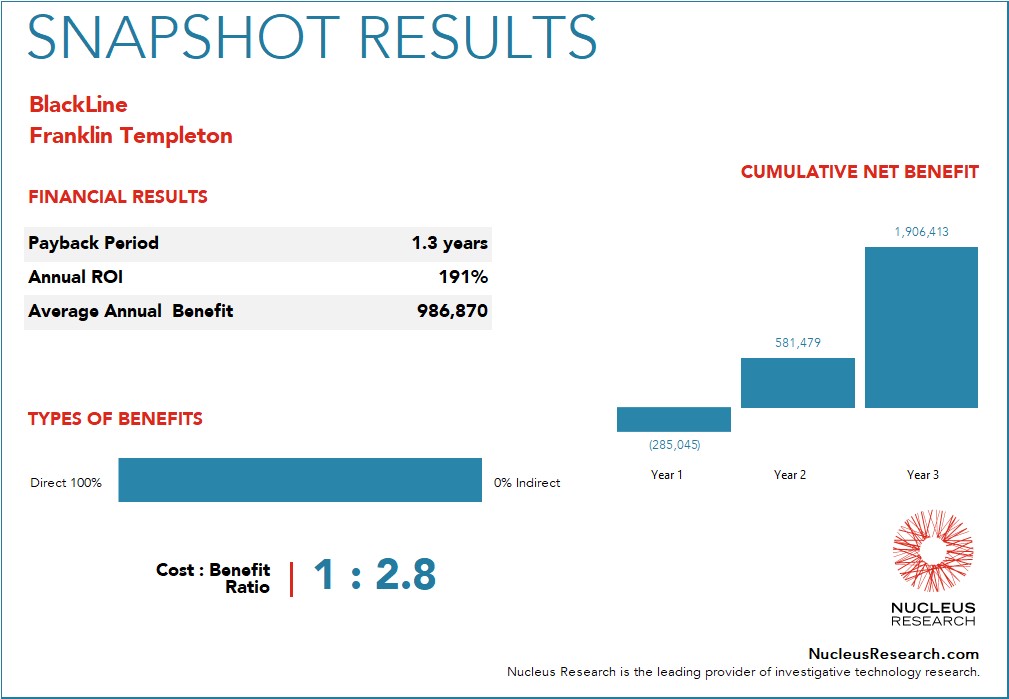

BlackLine ROI case study: Franklin Templeton

Franklin Templeton implemented BlackLine software as part of its effort to improve its monthly account reconciliation practices. The organization consolidated and standardized across its global operations, eliminating certain Excel-driven and manual processes. Further, the organization leveraged BlackLine’s Transaction Matching solution to enable daily transaction matching, thereby giving the accounting team the ability to resolve exceptions faster. Franklin Templeton also utilized BlackLine to deploy a new global risk profile framework, thus enabling the accounting team to focus on truly high-risk accounts early in the close process. The firm was able to improve its reconciliations by providing transparency throughout the process and strengthening the internal control, as well as reduce its operating costs by lowering headcount and shifting workloads to low-cost locations. Franklin Templeton has plans to expand its use of BlackLine to include other automated matching opportunities and auditor access.