What is IRR?

November 7, 2023

Internal Rate of Return (IRR) is a topic that just won’t die. It came up during a conversation with a few CEOs here in Maimi when one insisted it was the best way to evaluate a project. His reasoning was that IRR took into account the time value of money while ROI did not. When I commented that it didn’t do that, his response was that his investors use it and they’ve been successful.

Well, okay then.

Of course, that’s a ridiculous response but “time value of money” seems to be a recurring argument when discussing IRR. I’ve heard it a few times. IRR, to recap, is the NPV calculation solved for the interest rate (i). It is the interest (or discount) rate you would use to set the NPV calculation of a stream of payments to 0. Use a rate higher than that and your NPV will be negative. Lower than the IRR value and the NPV calculation is positive. You can draw the conclusion that if the IRR you calculate is greater than the current cost of capital (or borrowing rate) your project will return some amount of money to you. That’s all it tells you. It doesn’t tell you how much money or whether it’s a good project compared to others. Just that the NPV will be positive if the cost of capital is less than the IRR.

Time for a few examples.

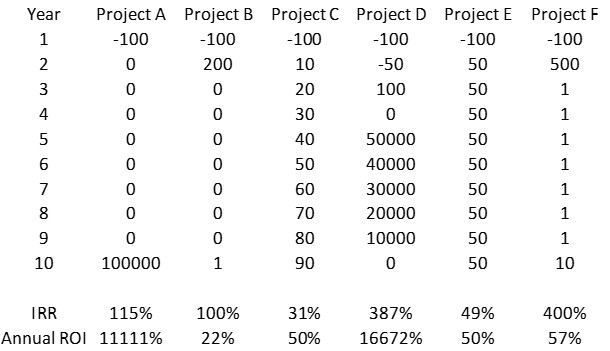

I’ve created a table with 6 projects to examine IRR vs ROI. The projects all begin with a $100 investment and run for 9 additional years. They have different benefits streams for the 9 years. The IRR is calculated using the stream of all 10 years while the annual ROI is calculated by averaging the benefits over the 9-year period and then dividing by the initial year. That’s just as a bank would do if you put $100 into a 9-year certificate of deposit.

Ignore the ROI and IRR calculations for a second and just look at the returns. You quickly see project A and D look great while project B isn’t that enticing. Now take a close look at the IRR and ROI calculations. Relying on IRR has you putting your reputation on project F for budget. Fine, but not great. Especially against the obviously strong project D. You’re also choosing project E over C even though both have the same ROI. How’s your reputation with the CFO doing?

What’s going on here?

The IRR calculation will be close to the ROI calculation when the streams at each year are relatively level. Any variation in return (say for instance in the real world) and IRR will vary from ROI and will steer you to a bad decision, either by calculating too high or too low relative to the real ROI.

As we’ve said before… just say no to IRR.